Floods can cause significant damage to homes and properties, leading to financial losses for homeowners. To protect against such losses, many homeowners opt for flood insurance coverage. However, it’s important to understand the deductible for flood insurance and its implications. In this article, Simun will delve into the key considerations related to flood insurance deductibles, helping homeowners make informed decisions about their coverage.

Understanding the Deductible for Flood Insurance: Key Considerations

Understanding the deductible for flood insurance is crucial for homeowners seeking protection against flood-related losses. By considering factors such as affordability, risk assessment, and the implications of the deductible, homeowners can make informed decisions about their coverage. Regular review and deductible for flood insurance adjustment of the deductible, along with a comprehensive assessment of the property’s flood risk, will ensure that homeowners have the appropriate coverage in place to safeguard their homes and finances in the face of potential flood damage.

I. What is a Deductible for Flood Insurance?

A deductible is the amount of money that a policyholder must pay out of pocket before their flood insurance coverage kicks in. It is the portion of the claim that the homeowner is responsible for paying before the insurance company covers the remaining costs. The deductible is typically a fixed dollar amount or a percentage of the insured value of the property.

II. Determining the Amount of the Deductible:

- Fixed Dollar Amount Deductibles:

- Explanation: With a fixed dollar amount deductible for flood insurance, the homeowner is responsible for paying a specific dollar amount before the insurance coverage begins.

- Considerations: Homeowners must consider their financial situation and the potential costs of flood damage when choosing a fixed dollar amount deductible.

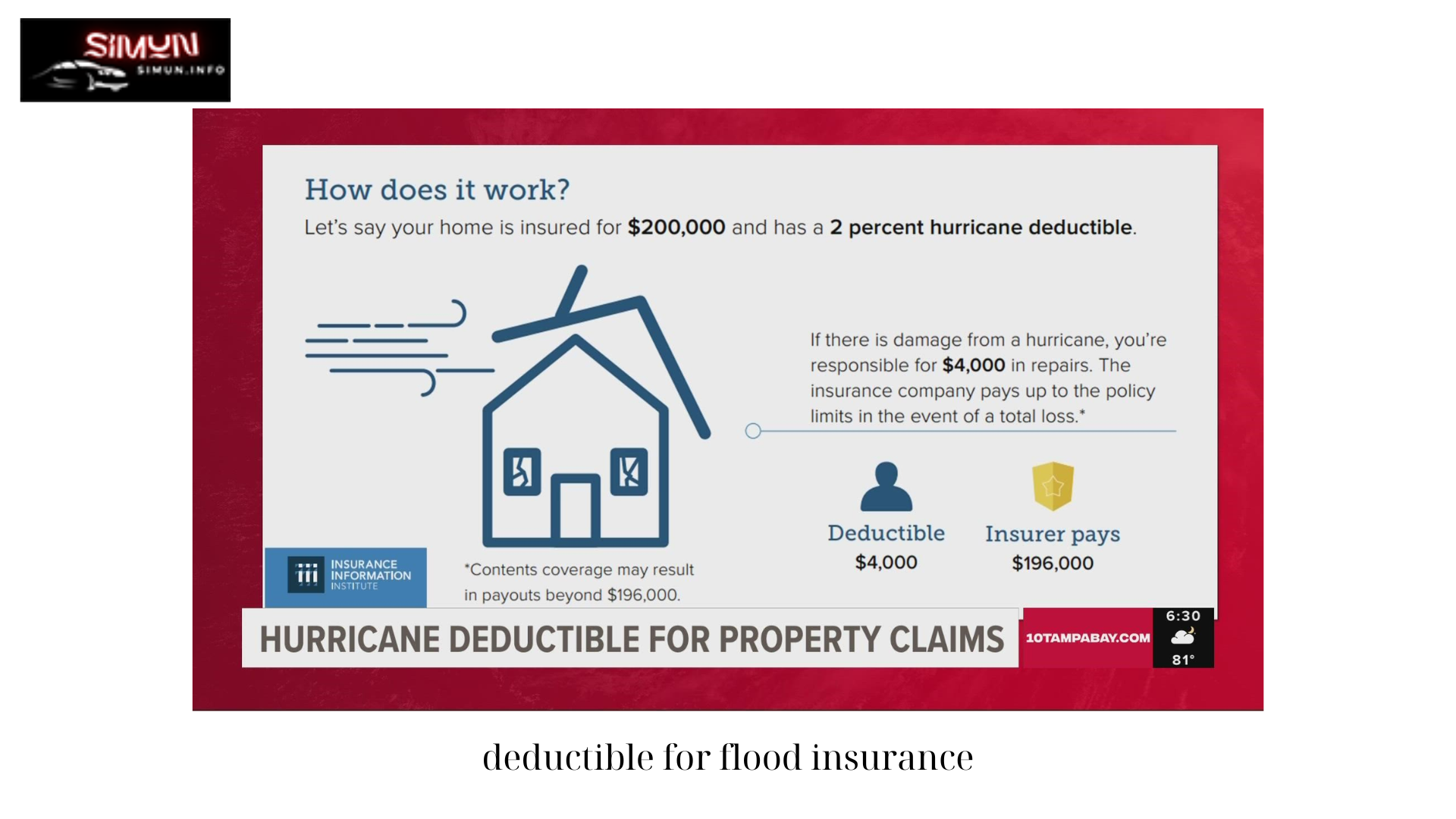

- Percentage-Based Deductibles:

- Explanation: A percentage-based deductible for flood insurance is calculated as a percentage of the insured value of the property. For example, if the insured value of the property is $200,000 and the deductible is set at 2%, the homeowner must pay $4,000 before the insurance coverage applies.

- Considerations: Homeowners should carefully assess the insured value of their property and calculate the potential deductible amount based on the specified percentage.

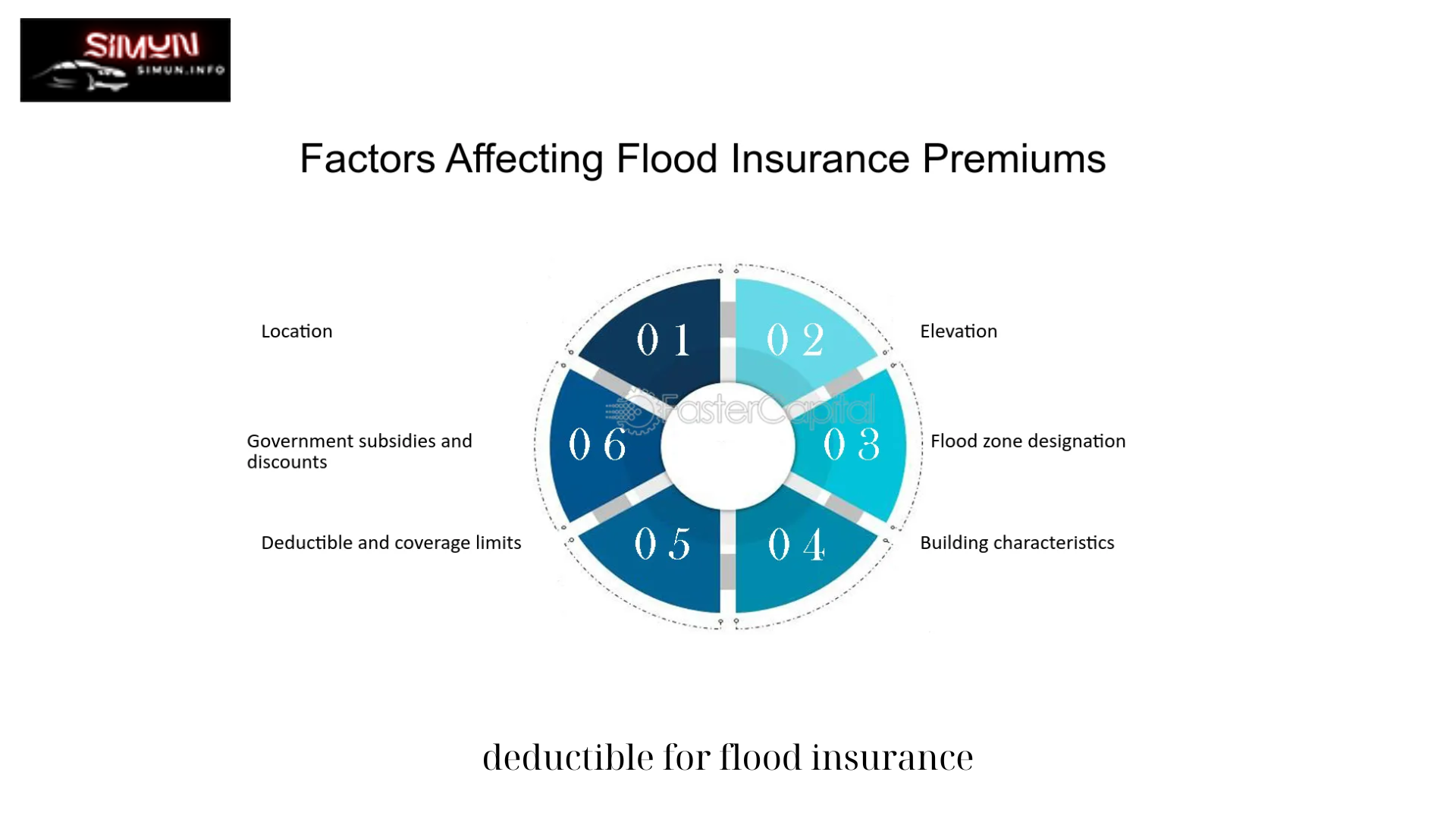

III. Factors to Consider When Choosing a deductible for flood insurance:

Regular review and deductible for flood insurance adjustment of the deductible, along with a comprehensive assessment of the property’s flood risk, will ensure that homeowners have the appropriate coverage in place to safeguard their homes and finances in the face of potential flood damage.

- Affordability:

- Financial Considerations: Homeowners should evaluate their financial capacity to pay the deductible in the event of a flood. A deductible that is too high may be burdensome for some homeowners.

- Risk Assessment:

- Location: The risk of flooding varies based on the property’s location. Homeowners in flood-prone areas may want to consider a lower deductible for flood insurance to minimize out-of-pocket expenses.

- Cost-Benefit Analysis:

- Premiums vs. Deductible: Homeowners deductible for flood insurance should compare the cost of premiums with the potential savings from choosing a higher deductible. A higher deductible could result in lower premiums, but it also means shouldering a greater financial burden in the event of a flood.

IV. Implications of the Deductible:

- Out-of-Pocket Expenses:

- Financial Responsibility: Homeowners must be deductible for flood insurance to pay the deductible amount upfront if their property sustains flood damage.

- Deductible Reset: In the event of subsequent flood events, homeowners may have to pay a new deductible for each occurrence.

- Insurance Claim Process:

- Timing: Insurance coverage will only apply once the deductible has been paid, which can delay the claim settlement process.

- Documentation: Homeowners should keep thorough records of their deductible payment and any expenses incurred during the claim process.

V. Deductible Options for Different Types of Properties:

- Residential Properties:

- Single-Family Homes: Homeowners can choose a deductible for flood insurance based on their specific needs and financial circumstances.

- Condominiums: Condo owners may have different deductible options depending on the master policy of the condo association.

- Commercial Properties:

- Business Considerations: Commercial property owners should carefully assess the deductible options based on their business requirements and financial capabilities.

VI. Reviewing and Adjusting Deductibles:

- Policy Renewals:

- Annual Review: deductible for flood insurance should review their flood insurance policy annually, considering any changes in their financial situation or property value that may warrant an adjustment to the deductible.

- Reevaluating Deductibles:

- Life Changes: Significant life events, such as home renovations, changes in income, or changes in the property’s flood risk, may necessitate a reassessment of the deductible.

VII. Conclusion:

Understanding the deductible for flood insurance is crucial for homeowners seeking protection against flood-related losses. By considering factors such as affordability, risk assessment, and the implications of the deductible, homeowners can make informed decisions about their coverage. Regular review and deductible for flood insurance adjustment of the deductible, along with a comprehensive assessment of the property’s flood risk, will ensure that homeowners have the appropriate coverage in place to safeguard their homes and finances in the face of potential flood damage.

Conclusion: So above is the Understanding the Deductible for Flood Insurance: Key Considerations article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: BIRA.INFO