Living in areas prone to flooding comes with the responsibility of protecting your property and assets. One of the key considerations for homeowners and businesses in flood-prone areas is whether their specific zone requires flood insurance so in this article, Simun will delve into Zone AE and explore does zone ae require flood insurance. By understanding the requirements does zone ae require flood insurance, you can make informed decisions to safeguard your property and financial well-being.

Does Zone AE Require Flood Insurance? Understanding the Requirements

Understanding the flood insurance requirements in Zone AE is crucial for property owners in flood-prone areas. While flood insurance is generally required for properties in high-risk flood zones, it is a wise decision for all property owners to consider obtaining coverage, regardless of their zone designation.

By working with insurance professionals, evaluating does zone ae require flood insurance and flood risk, and implementing mitigation measures, property owners can protect their assets and have peace of mind in the face of potential flooding events. Remember, being prepared and adequately insured is key to minimizing the financial impact of a flood and ensuring the long-term stability of your property.

- What is Zone AE?

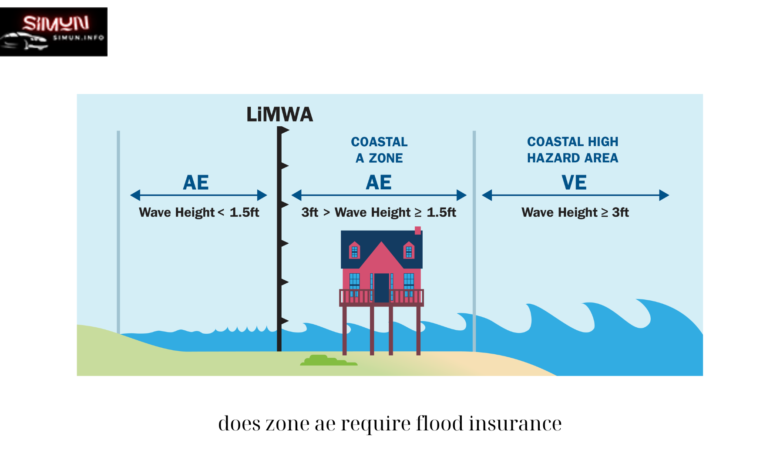

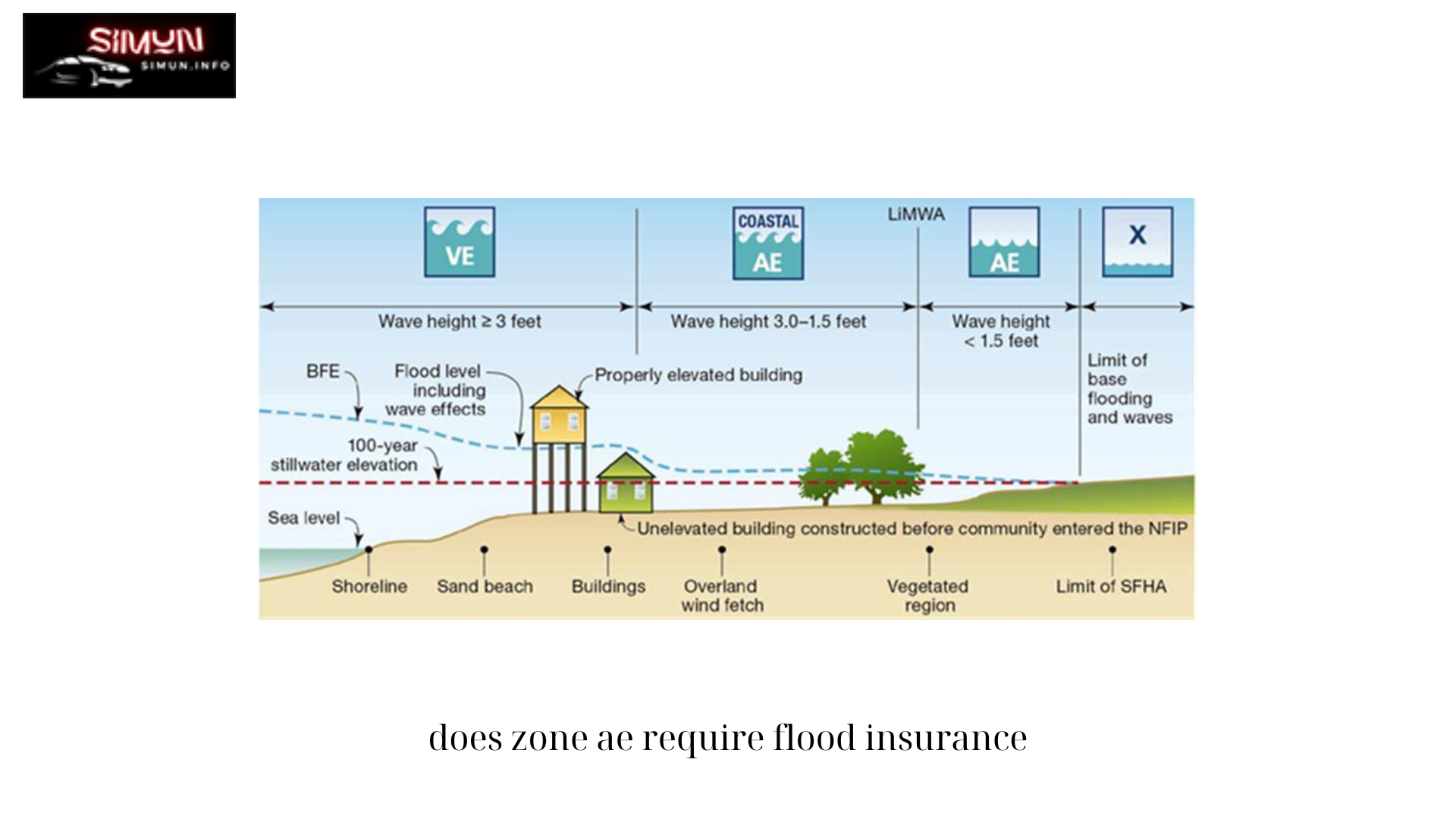

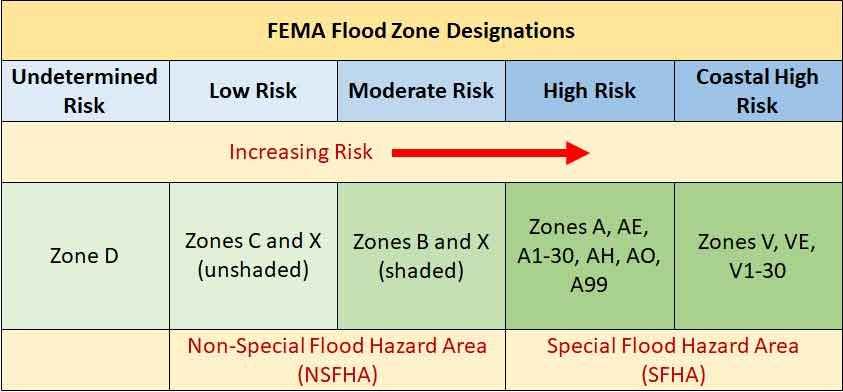

Zone AE is a flood zone designation used by the Federal Emergency Management Agency (FEMA) to classify areas with a high risk of flooding. Does zone ae require flood insurance? These zones are typically located near bodies of water, such as rivers, lakes, or coastal regions. The designation takes into account factors such as historical flood data, hydrological studies, and elevation levels to determine the flood risk. - The Role of FEMA in Flood Insurance:

FEMA plays a crucial role in flood insurance by does zone ae require flood insurance administering the National Flood Insurance Program (NFIP). The NFIP aims to provide affordable flood insurance coverage to property owners in flood-prone areas. FEMA establishes flood zones, including Zone AE, to assess the level of flood risk and determine the need for flood insurance. - Understanding Flood Insurance Requirements in Zone AE:

In Zone AE, flood insurance requirements can vary depending on whether your property is located in a high-risk Special Flood Hazard Area (SFHA) or a moderate-to-low risk area. If your property falls within an SFHA, which includes Zone AE, and you have a mortgage from a federally regulated lender, you are typically required to obtain flood insurance. - The Importance of Flood Insurance in Zone AE:

Flood insurance in Zone AE is essential because does zone ae require flood insurance it provides financial protection against flood-related damages. While traditional homeowners’ insurance policies often exclude coverage for flood damage, flood insurance specifically covers losses resulting from flooding. Without adequate coverage, property owners in Zone AE may face substantial financial burdens in the event of a flood.

- Understanding Coverage and Policy Options:

Flood insurance policies in does zone ae require flood insurance typically provide coverage for both the structure and contents of a property. Structural coverage includes the building itself, including its foundation, electrical systems, plumbing, and appliances. Content coverage includes personal belongings, furniture, and other items within the property. It’s important to review policy details, coverage limits, and exclusions to ensure you have the appropriate level of protection. - Evaluating Flood Risk and Elevation Certificates:

To determine flood insurance rates in does zone ae require flood insurance, insurers often require an Elevation Certificate. This certificate provides information about the elevation of the property’s lowest floor relative to the base flood elevation (BFE). Properties located above the BFE may be eligible for lower insurance premiums, as they are considered to have a lower flood risk. - Consultation with Insurance Professionals:

To navigate the complexities of flood insurance requirements in Zone AE, it is advisable to consult with insurance professionals who specialize in flood insurance. They can assist in evaluating your specific property, explaining coverage options, and providing guidance on compliance with flood insurance requirements. - Additional Considerations for Property Owners:

While flood insurance is typically required for properties in Zone AE with mortgages from federally regulated lenders, it is essential to understand that even properties located outside of high-risk areas can still be vulnerable to flooding. Therefore, obtaining flood insurance is a prudent decision for all property owners in flood-prone regions, regardless of their zone designation. - Mitigation Measures to Reduce Flood Risk:

In addition to obtaining flood insurance, property owners in Zone AE can take proactive steps to mitigate flood risk. These measures may include elevating the property, installing flood-resistant barriers, improving drainage systems, and implementing landscaping techniques that promote water runoff.

- Conclusion:

Understanding does zone ae require flood insurance the flood insurance requirements in Zone AE is crucial for property owners in flood-prone areas. While flood insurance is generally required for properties in high-risk flood zones, it is a wise decision for all property owners to consider obtaining coverage, regardless of their zone designation. With working with insurance professionals, evaluating flood risk, and implementing mitigation measures, property owners can protect their assets and have peace of mind in the face of potential flooding events. Remember, being prepared and adequately insured is key to minimizing the financial impact of a flood and ensuring the long-term stability of your property.

Conclusion: So above is the Does Zone AE Require Flood Insurance? Understanding the Requirements article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: BIRA.INFO