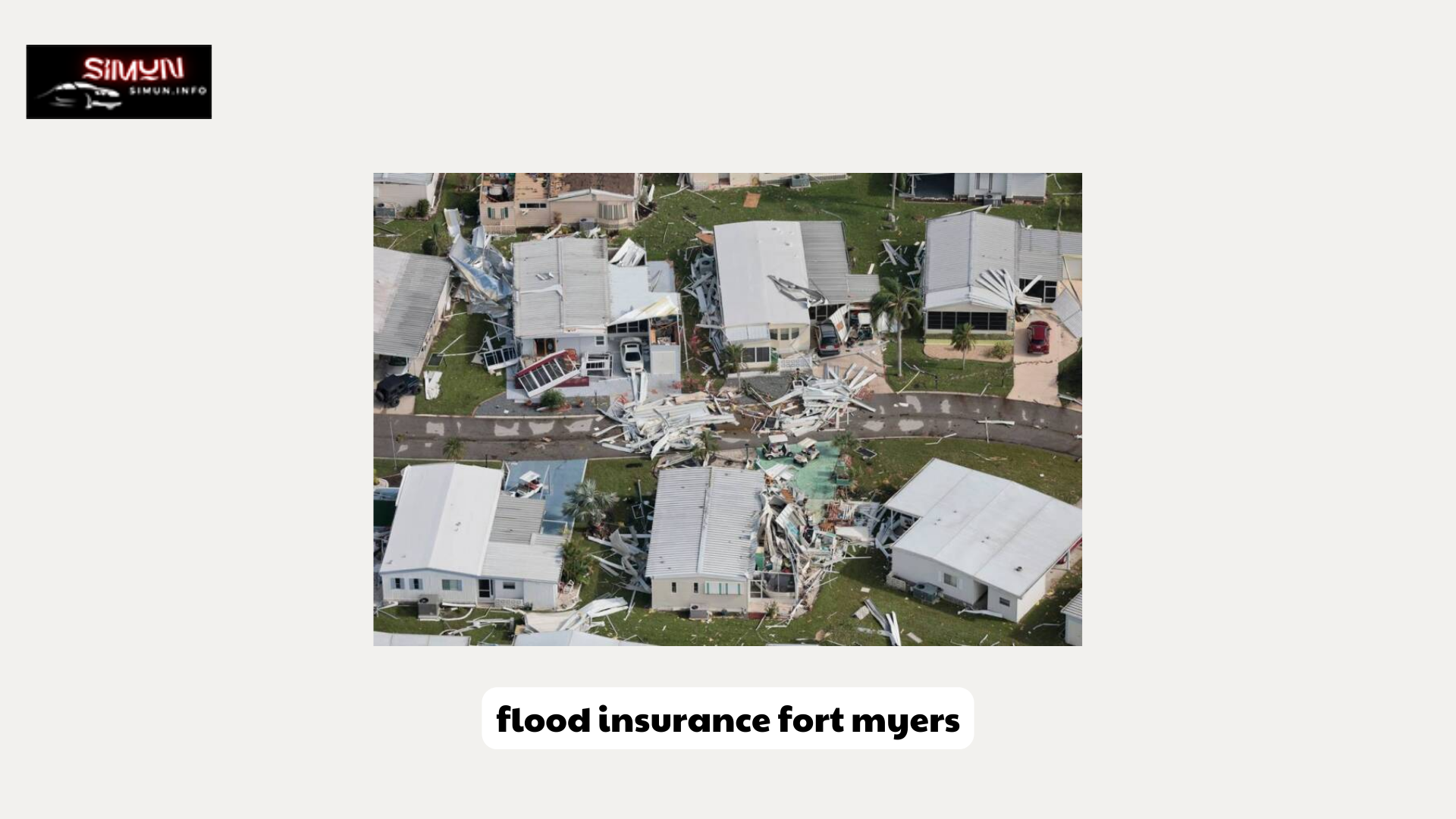

Living in Fort Myers, a city located in Southwest Florida, means being surrounded by beautiful coastal areas and waterways. While the proximity to water offers many recreational opportunities and a picturesque landscape, it also brings the risk of flooding. Fort Myers, like many other coastal cities, is susceptible to flooding from heavy rain, storm surges, hurricanes, and tropical storms. To protect your property and finances from the devastating effects of flooding, it is essential to understand and consider purchasing flood insurance. In this comprehensive guide, Simun will delve into the intricacies of flood insurance fort myers, providing you with the knowledge needed to make informed decisions.

Understanding Flood Insurance Fort Myers: A Comprehensive Guide

The Importance of Flood Insurance

Floods can cause significant damage to homes and properties, often resulting in high repair costs and financial hardship. Many homeowners mistakenly believe that their standard homeowners’ insurance policy covers flood damage. However, this is generally not the case. Homeowners insurance typically excludes coverage for flood-related losses, making flood insurance fort myers a crucial safeguard against potential financial ruin. By obtaining flood insurance, you can protect yourself from the financial burden that comes with repairing or rebuilding your home after a flood.

The National Flood Insurance Program (NFIP)

The National flood insurance fort myers Program (NFIP) is a federal program established by the Federal Emergency Management Agency (FEMA) to provide flood insurance coverage to property owners in participating communities across the United States. Fort Myers is one such participating community, allowing homeowners and renters in the area to purchase flood insurance fort myers through the NFIP. The NFIP aims to reduce the impact of flooding on individuals and communities by providing affordable flood insurance, promoting floodplain management, and encouraging flood risk awareness.

Coverage Options

Flood insurance policies typically offer two types of coverage: building coverage and contents coverage. Building coverage protects the structure of your home, including its foundation, walls, electrical and plumbing systems, and major appliances. Contents coverage, on the other hand, covers your personal belongings, such as furniture, clothing, electronics, and valuables. It is essential to evaluate your property’s specific needs and determine the appropriate coverage amount for both the building and its contents. Consulting with a knowledgeable insurance agent can help you assess your requirements and select the right coverage options.

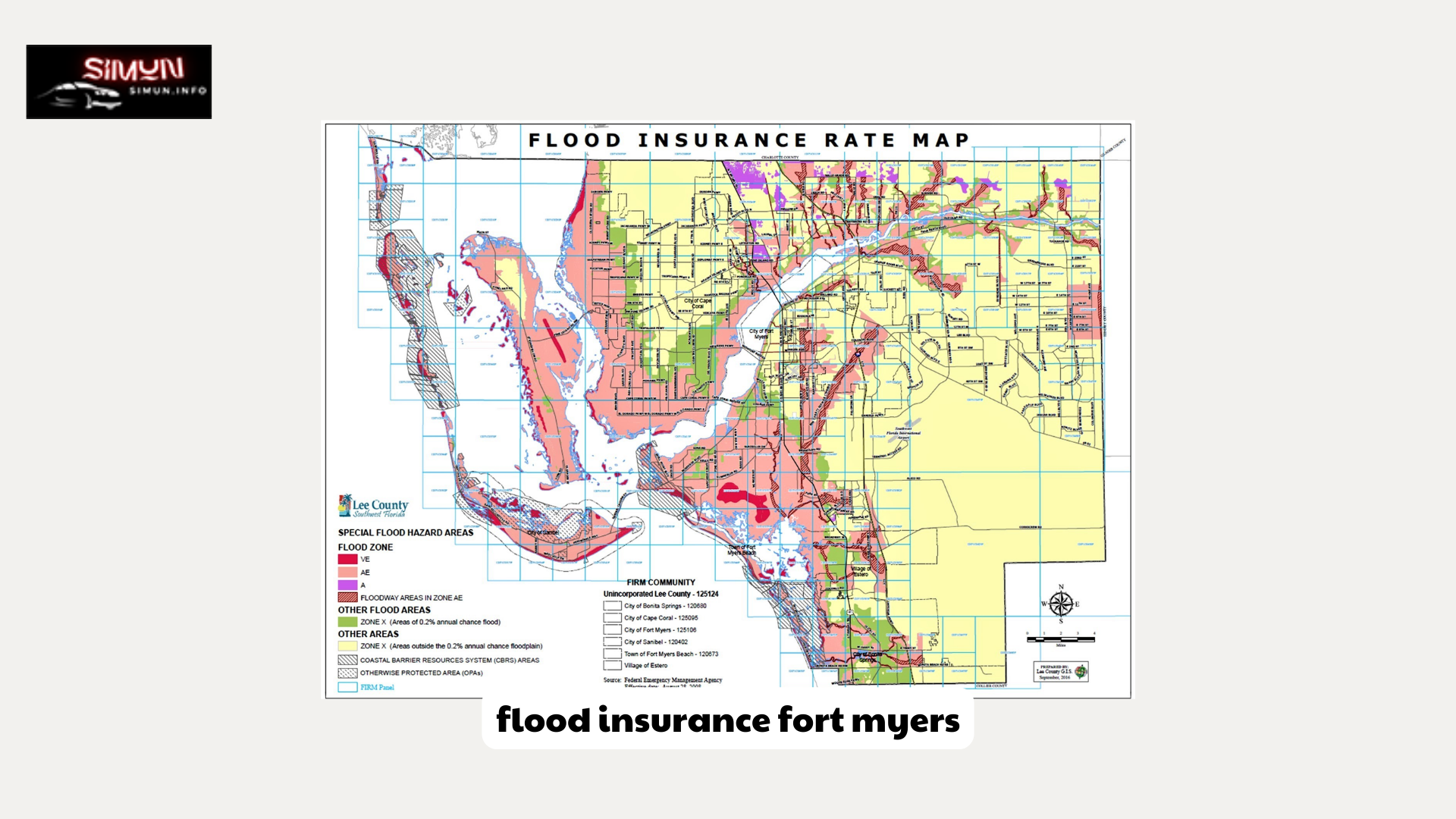

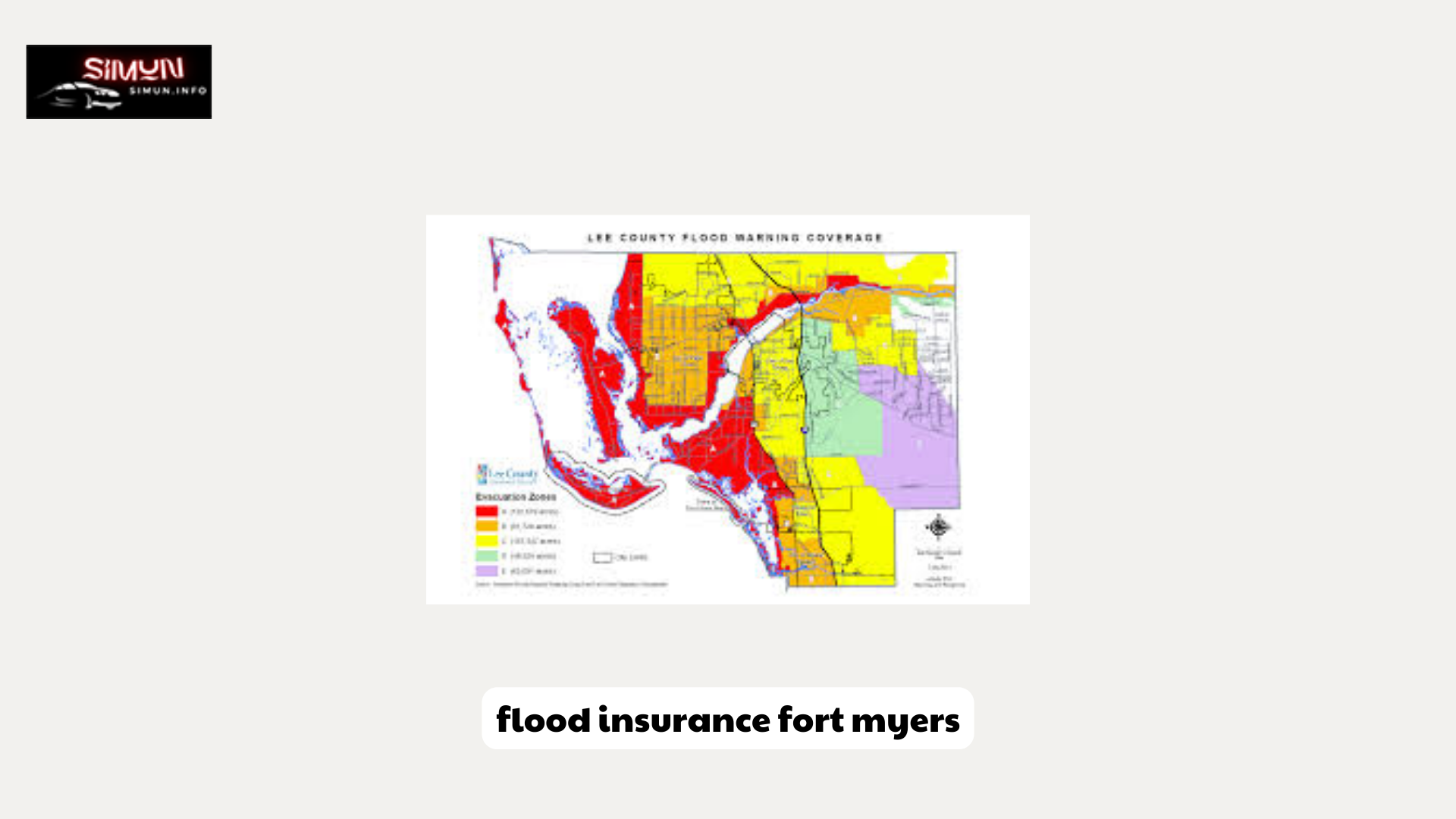

Understanding Flood Zones

Flood zones are geographical areas that have been designated based on the level of flood risk they present. In Fort Myers, flood zones are determined by FEMA’s flood insurance fort myers Rate Map (FIRM). The FIRM identifies areas prone to flooding and assigns them different flood zone designations, such as Zone A, Zone AE, Zone VE, and Zone X. These designations indicate the severity of the flood risk, with Zone A being the highest-risk area. Your flood insurance premium may vary depending on the flood zone in which your property is located. It is important to familiarize yourself with your property’s flood zone and its implications for your insurance coverage.

Determining flood insurance fort myers Costs

Several factors influence the cost of flood insurance Fort Myers. These include your property’s location, elevation, flood zone designation, the value of the building and its contents, and the chosen coverage limits. The NFIP sets rates based on these factors, and the premiums can vary significantly. Properties located in high-risk flood zones, such as coastal areas, generally have higher premiums compared to those in lower-risk zones. Additionally, properties built in compliance with floodplain management regulations may be eligible for lower-cost Preferred Risk Policies. It is advisable to consult with an insurance agent to obtain accurate quotes and determine the cost of flood insurance fort myers for your specific property.

Flood Insurance Claims Process

In the unfortunate event of a flood, filing a flood insurance fort myers claim is crucial to receive the necessary financial compensation for the damages incurred. It is essential to act promptly and follow the proper procedures to ensure a smooth claims process. Start by documenting the damage thoroughly through photographs and written descriptions. Notify your insurance company as soon as possible and provide them with the necessary information and documentation. An adjuster will visit your property to assess the damage and estimate the repair costs. It is important to keep copies of all communications and documents related to your claim for reference and to facilitate the resolution process.

Private Flood Insurance Options

While the NFIP is the primary source of flood insurance for most homeowners in Fort Myers, there are also private insurance companies that offer flood insurance fort myers policies. Private flood insurance options may provide additional coverage enhancements or different pricing structures compared to the NFIP policies. If you are considering private flood insurance, it is essential to carefully review the policy terms, coverage limits, and exclusions to ensure it meets your specific needs. Consulting with an insurance professional can help you navigate the private flood insurance market and make an informed decision.

Mitigation and Floodplain Management

In addition to obtaining flood insurance, taking proactive measures to mitigate flood risk can help protect your property and reduce potential damage. Fort Myers, like many other communities, has floodplain management regulations in place to guide development and construction practices in flood-prone areas. These regulations aim to minimize the impact of flooding on structures and promote community resilience.Additionally, there are various mitigation strategies that homeowners can implement, such as elevating their homes, installing flood-resistant materials, and improving drainage systems. These measures can help reduce flood damage and lower insurance premiums. It is important to consult with local authorities, contractors, or floodplain managers to understand the specific requirements and recommendations for mitigating flood risk in your area.

Conclusion

In Fort Myers, where the risk of flooding is a reality, understanding flood insurance fort myers is essential for homeowners and renters alike. By grasping the importance of flood insurance fort myers coverage, exploring the options available through the NFIP, understanding flood zones, determining costs, knowing the claims process, and considering private insurance alternatives, you can make informed decisions to protect your property and finances from the devastating effects of floods.

Additionally, taking proactive steps to mitigate flood risk through floodplain management and property enhancements can further safeguard your home. Remember, knowledge and preparedness are key when it comes to flood insurance, so take the necessary steps to ensure you and your property are adequately protected.

Conclusion: So above is the Understanding Flood Insurance Fort Myers: A Comprehensive Guide article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: BIRA.INFO