Experiencing a flood can be a devastating event that wreaks havoc on your property and belongings. In such situations, having flood insurance can provide financial relief and help you recover from the damages however, navigating the flood damage insurance claim process can be complex and overwhelming so this article by Simun aims to provide you with essential tips to successfully navigate the flood damage insurance claim tips, ensuring you receive the coverage you deserve.

Flood Damage Insurance Claim Tips: Navigating the Process Successfully

I. Understanding Your Policy:

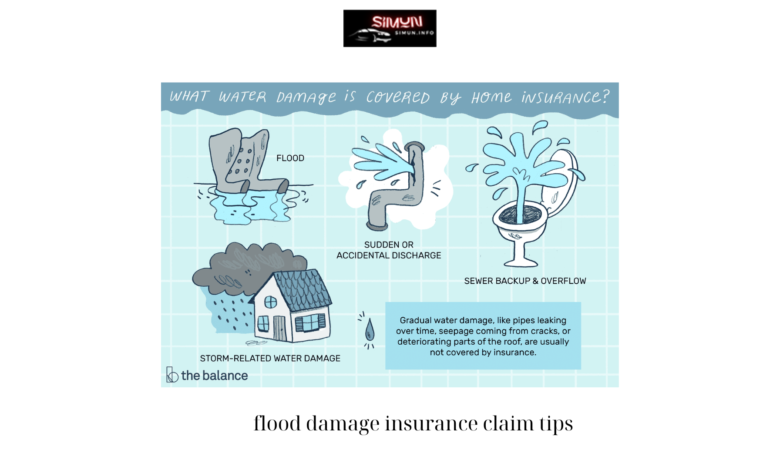

Before filing a flood damage insurance claim, it is crucial to thoroughly understand your insurance policy. Take the time to review the coverage details, including the specific types of damages covered, policy limits, deductibles, and any exclusions. Understanding your policy’s terms and conditions will help you set realistic expectations and avoid potential surprises during the claim process.

II. Documenting the Damage:

Proper documentation of the flood damage is vital for a successful insurance claim. As soon as it is safe to do so, take photographs or videos of the affected areas, capturing the extent of the damage. Make a detailed inventory of damaged items, including their descriptions, approximate values, and purchase dates if available. This documentation will serve as crucial evidence for your claim and help ensure you receive adequate compensation.

III. Contacting Your Insurance Company:

Once you have documented the damage, it is essential to contact your insurance company promptly. Report the flood damage and initiate the claims process by providing them with all the necessary information. Be prepared to provide details about the cause of the flood, the extent of the damage, and any temporary repairs you have made to prevent further harm. Keep a record of all communication with your insurance company, including the names of representatives you speak with and the dates and times of the conversations.

IV. Mitigating Further Damage:

After reporting the flood damage, take immediate steps to mitigate further flood damage insurance claim tips to your property. This may involve hiring professionals to perform emergency repairs or taking temporary measures to prevent additional harm. However, it is essential to consult with your insurance company before proceeding with any repairs to ensure they are covered and to avoid potential claim denials.

V. Working with Insurance Adjusters:

During the flood damage insurance claim process, an flood damage insurance claim tips adjuster will be assigned to assess the damages and determine the appropriate compensation. It is crucial to cooperate with the adjuster and provide them with access to the damaged areas and the documentation you have collected. Walk through your property with the adjuster, pointing out all the damages and explaining the extent of the loss. Be honest and thorough in your descriptions, ensuring that no damage is overlooked.

VI. Obtaining Multiple Estimates:

To ensure a fair and accurate assessment of the damages, it is advisable to obtain multiple estimates from reputable contractors or restoration professionals. These estimates can serve as evidence of the reasonable cost of repairs and help support your claim. Provide copies of these estimates to your insurance company to facilitate the claims process and ensure that you are adequately compensated for the damages.

VII. Keeping Detailed Records:

Throughout the flood damage insurance claim tips, it is essential to keep detailed records of all relevant documents, including emails, letters, receipts, and any other communication or transactions related to the claim. This documentation will help you track the progress of your claim, provide evidence of your efforts to cooperate with the insurance company, and serve as a reference if any disputes arise.

VIII. Seeking Professional Assistance:

If you encounter challenges or disputes during the flood damage insurance claim process, it may be beneficial to seek professional assistance. Public flood damage insurance claim tips adjusters or attorneys specializing in insurance claims can provide guidance, negotiate on your behalf, and help ensure that you receive fair compensation. However, it is important to carefully consider the associated costs and fees before engaging their services.

IX. Reviewing the Settlement:

Once your insurance company has flood damage insurance claim tips your flood damage insurance claim, they will provide a settlement offer. Carefully review the settlement to ensure that it addresses all the damages and losses you have suffered. If you believe the offer is inadequate or if any aspects of your claim have been overlooked, you have the right to negotiate with the insurance company and request a fair and reasonable settlement.

X. Appealing a Denied Claim:

In unfortunate cases where your flood damage insurance claim tips is denied, you have the option to appeal the decision. Review the denial letter carefully to understand the reasons for the denial. If you believe the denial is unjustified, gather additional evidence or seek professional assistance to support your appeal. Follow the appeal process outlined by your insurance company, providing any necessary documentation, and presenting a strong case for reconsideration.

Conclusion:

Navigating the flood damage insurance claim tips can be challenging, but with the right knowledge and approach, you can increase your chances of a successful claim. Understanding your policy, documenting the damage, promptly contacting your insurance company, and cooperating with flood damage insurance claim tips are key steps in the process. By staying organized, seeking professional assistance when needed, and advocating for fair compensation, you can navigate the process successfully and recover from the devastating effects of a flood. Remember, patience and persistence are crucial during this process.

Conclusion: So above is the Flood Damage Insurance Claim Tips: Navigating the Process Successfully article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: BIRA.INFO