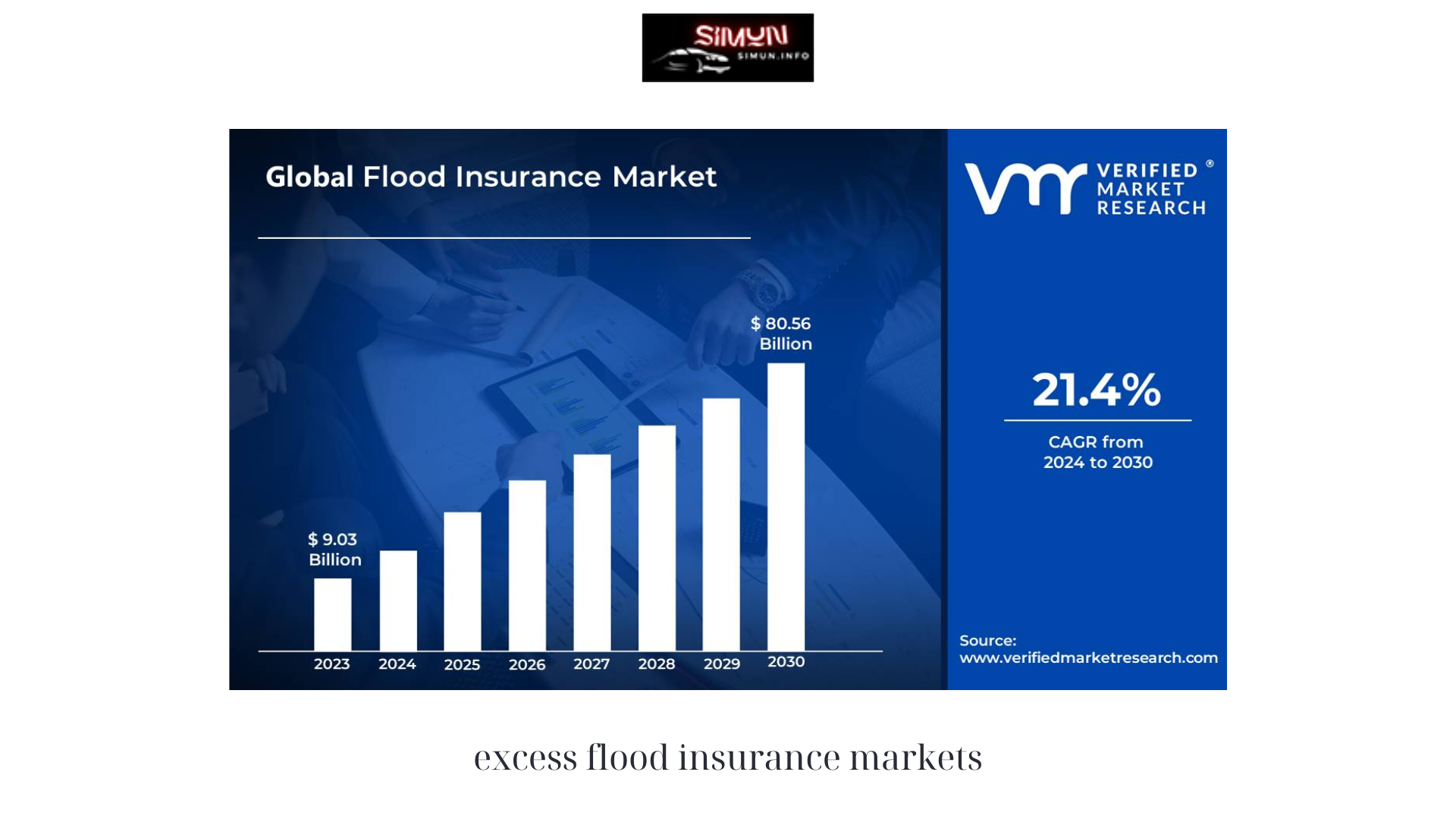

In recent years, the frequency and severity of flood events have increased significantly, posing a substantial risk to homeowners and businesses located in flood-prone areas to mitigate this risk, traditional flood insurance policies are often supplemented by an additional layer of coverage known as excess flood insurance so in this article, Simun will delve into the basics of excess flood insurance markets, exploring their purpose, key features, and benefits.

Understanding Excess Flood Insurance Markets: Exploring the Basics

- What is Excess Flood Insurance?

Excess flood insurance, also referred to as surplus lines or high-limit flood insurance, provides coverage above and beyond the limits of a primary excess flood insurance markets policy. While standard flood insurance policies offer coverage up to a certain limit, typically provided by the National Flood Insurance Program (NFIP) or private insurers, excess flood insurance steps in to provide additional coverage when the primary policy’s limits are exhausted.

- The Need for excess flood insurance markets

The primary reason for obtaining excess flood insurance is to protect against catastrophic losses that may exceed the coverage limits of a standard flood insurance policy. In areas prone to severe flooding or high-value properties, the potential damages resulting from a flood event can far exceed the limits set by traditional policies. Excess flood insurance markets acts as a financial safety net, ensuring that policyholders have adequate coverage in the event of a significant flood-related loss.

- Coverage and Limits

Excess flood insurance markets policies are customizable and can be tailored to the specific needs and risk profile of the insured property. These policies generally offer higher coverage limits than standard flood insurance, allowing policyholders to secure additional protection for their homes or businesses. The coverage provided by excess flood insurance typically includes the same perils covered by the primary flood insurance policy, such as damage caused by rising waters, storm surges, or heavy rainfall.

- Policy Structure and Underwriting

Excess flood insurance marketspolicies are underwritten by specialized insurers that focus on providing coverage for high-value properties or locations with increased flood risks. These insurers assess the property’s flood risk based on various factors, including its location, elevation, proximity to bodies of water, and historical flood data. The premiums for excess flood insurance are determined by the assessed risk, and the policy terms and conditions are tailored to the specific needs of the insured property.

- Eligibility and Availability

Excess flood insurance markets is generally available to homeowners, businesses, and property owners who already have a primary flood insurance policy in place. While primary flood insurance is typically obtained through the NFIP or private insurers, excess flood insurance is often sourced from surplus lines insurers. Surplus lines insurers are specialized insurance carriers that offer coverage that is not available or hard to obtain through the standard insurance market.

- Benefits of Excess Flood Insurance

The primary benefit of excess flood insurance markets is the enhanced level of coverage it provides. By extending the coverage limits, policyholders can achieve greater financial protection and peace of mind in the face of catastrophic flood events. Excess flood insurance also allows property owners to tailor their coverage to their specific needs, ensuring that their valuable assets are adequately protected.

- Considerations and Limitations

While excess flood insurance markets offers significant advantages, there are a few considerations and limitations to keep in mind. First, policyholders should carefully review the terms, conditions, and exclusions of the excess flood insurance policy to understand the extent of coverage provided. Additionally, the cost of excess flood insurance can be higher than standard flood insurance due to the increased coverage limits and higher risk profile associated with the insured property.

- Working with Insurance Professionals

Navigating the complexities of excess flood insurance markets can be challenging. It is advisable to work with experienced insurance professionals who specialize in flood insurance and have knowledge of the excess market. These professionals can help assess the specific needs of the property, identify appropriate coverage limits, and assist in obtaining excess flood insurance policies from reputable insurers.

- The Future of Excess Flood Insurance Markets

As flood risks continue to evolve due to climate change and urban development, the demand for excess flood insurance is likely to grow. Insurance companies are continually refining their underwriting processes and expanding their offerings to meet the evolving needs of the market. Additionally, advancements in flood modeling and risk assessment technologies are enabling insurers to better evaluate flood risks and provide more accurate coverage options.

- Conclusion

Excess flood insurance markets play a vital role in providing enhanced coverage and financial protection for homeowners and businesses exposed to significant flood risks. By understanding the basics of excess flood insurance, property owners can make informed decisions about their flood insurance needs and ensure they have adequate coverage in place. As with any insurance product, it is crucial to carefully review policy terms and work with knowledgeable professionals to secure the most suitable coverage for your property’s specific risk profile.

Conclusion: So above is the Understanding Excess Flood Insurance Markets: Exploring the Basics article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: BIRA.INFO