Erie Insurance: Get the Best Rate Car Insurance

For those who reside in one of the 12 states where Erie Insurance is available, it’s the Best Rate Car Insurance for them. Erie has some of the best pricing out now, and people highly recommend their customer service. The company’s relative lack of online resources is a disadvantage to Erie’s auto and house insurance. Let’s simun.info explored all types of Eries Insurance and know how to get this Best Rate Car Insurance.

An overall of Erie Insurance- the Best Rate Car Insurance:

Exclusively through its network of independent brokers, Erie sells insurance. In order to buy insurance, file claims, and manage their policies, Erie clients will largely communicate with the company through agents. All claims other than those for glass repair must be submitted via an agent or the Erie claims hotline. Erie Insurance- the Best Rate Car Insurance provides coverage alternatives that are comparable to or better than those provided by other insurers. The “Rate Lock” feature of Erie’s auto insurance is one of its greatest advantages.

If you meet the requirements and add Rate Lock to your policy, Erie won’t increase your rates on an annual basis until you change the drivers or vehicles covered by your policy or relocate from your existing address. If you have an accident or file a claim, your rate won’t change. The online resources offered by Erie are less feature-rich than those of some of its rivals. For instance, you cannot obtain a homeowners insurance estimate online; instead, you must speak with an agent. Auto quotes are available online, but there are few online customization choices, and you must work with an agent to buy a policy.

The types of insurance that Erie Insurance offers to the customer:

When looking for auto insurance, it’s critical to know what kind of coverage you need and want, as well as what you must purchase. To drive a car, you need insurance in most states. State-by-state minimum coverage requirements may differ, but they often call for liability insurance and uninsured/underinsured motorist protection.

Full coverage insurance can be something you’re interested in if you desire more security. Full coverage is a combination of many types of insurance, including liability, collision, and comprehensive.

How the most popular types of auto insurance coverage operate by reading the list below:

- Liability for bodily harm and property damage:

Expenses related to accidents you caused that resulted in injuries, fatalities, or property damage. It is usually necessary for all cars.

- Coverage for uninsured or underinsured drivers

Expenses for medical care and property damage following a collision with a driver who is underinsured or not at all insured.

- Collision protection

Regardless of guilt, repair costs from traffic-related incidents. It could be needed for a car lease or loan.

- Complete protection

Repair expenses resulting from circumstances beyond your control, such as weather conditions, car accidents including animal collisions, theft, and vandalism. It could be needed for a car lease or loan.

How the most popular types of auto insurance coverage operate:

- Accident forgiveness: After three years as an Erie customer, you won’t be subject to a surcharge following your first accident in which you were at fault.

- Pet injury coverage: Up to $500 per pet, up to $1,000, for veterinarian care for animals hurt while riding in your car.

- Rate lock: This feature enables you to fix the cost of your auto insurance up until the time that you add or remove drivers, add or remove vehicles, alter your usual parking spot, or move. restricted in Virginia to three years.

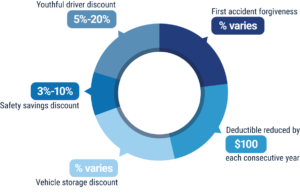

- Decreased deductible: You can get a $100 reduction in your deductible up to $500 for each year that goes by without you making a claim.

Erie- Best Rate Car Insurance offers extra benefits if you get comprehensive car insurance:

- If your windshield needs to be replaced, you can get glass replacement with no deductible and new wiper blades.

- If you lock your keys in your car, you may need a locksmith for up to $75.

- Clothing, baggage, and other personal things within an insured car are covered up to $350. Personal goods in the car are often not covered by auto coverage. The collision insurance offered by Erie also includes this extra.

For $35 a year or less, Erie’s Auto Plus package provides a number of features, some of which differ per state:

- After an accident, additional days of rental car coverage.

- Higher coverage limits for some things, like personal belongings and locksmith fees.

- The deductible on your auto insurance has occasionally been waived.

- a $10,000 per person death payout in the event of a covered accident.

Additional alternatives for auto insurance from Erie:

- Replacement of a new vehicle: If your vehicle is less than 24 months old and totaled, Erie will replace it, less the deductible, with a brand-new vehicle from the current model year. The availability of this varies by state.

- Better car replacement: This coverage will pay for a car of the same make and model that is two years newer, less the deductible, if your vehicle is at least 24 months old and is totaled. Not every state offers this coverage.

- Gap insurance: This policy will pay off your car loan if your vehicle is declared a total loss.

- Generous options for rental car coverage: Most auto insurers include rental car coverage at an additional expense, giving you a way to get around if your car is being repaired for covered damage. Erie’s complete coverage covers the fundamental coverage for free, but you can pay more for rental upgrades like a premium vehicle or an SUV rather than a sedan.

- Coverage for rideshare drivers: If you work as a driver for a company like Uber or Lyft, your insurance is only covered while you are driving or picking up customers; it is not covered while you are sitting about awaiting requests. Drivers who use ridesharing are covered by Erie’s insurance- the Best Rate Car Insurance.

Additionally, Erie offers an auto security package that includes gap insurance, better car replacement, and new car replacement.

How to get Erie Insurance- the Best Rate Car Insurance:

You must gather some fundamental data before comparing auto insurance providers. This includes the driving records of all policyholders as well as information on your car, such as its safety features and annual mileage. You should also decide what kinds of coverage you require. For instance, do you need more comprehensive coverage, such as gap insurance or rideshare coverage, or do you merely want the minimal minimum insurance that your state mandates? Verify sure any business you are thinking about offers the solutions you require.

Make sure all insurers are providing the same coverage limits and deductibles when comparing pricing. You might not want to base your choice solely on cost. Take a look at how many customer complaints each business has, as a high amount of complaints may be a warning sign for the level of service you may expect.

You might be able to purchase insurance online, over the phone, or through an agent, depending on the company you choose. See how to get auto insurance for more information.

Conclusion:

Erie has solid coverage options and receives high marks for handling accident repair claims. These benefits balance out Erie’s variable auto insurance premiums, which are based on your driving history. Choosing to buy Erie Insurance– Best Rate Car Insurance is the most effective way to protect yourself and your car. Thank you for reading!

Conclusion: So above is the Erie Insurance: Get the Best Rate Car Insurance article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: BIRA.INFO